Remove the Fear of Bank Runs with Digital Self Custody

Understanding the Bank Run Phenomenon and the Benefits that Blockchain Self-Custody Provides

Welcome to the 1 new 12 Cities, 12 Months subscribers who have joined us since last Wednesday! If you haven’t subscribed, join 11 other people who are following the journey!

Hey everyone! For those who typically read this blog (friends, family, and any other poor souls who deal with my bs), you probably weren’t affected by the recent Silicon Valley Bank (SVB) collapse. There has been lots of debate in the media and on Twitter about whether or not it was right for the government to step in and backstop the collapse and ensure that SBV depositors would have access to their funds.

Although I am definitely not the one to be touting a reasonable opinion on the matter since I am just a 23-year-old recent college grad with no finance experience other than a degree in it, I believe the government took the right action here. We were on the brink of seeing thousands of American companies building the future go belly up for nothing they did wrong.

Since I’m living with someone in Charlotte at the moment who works in IB, it’s been easy for me to keep tabs on the situation, and I’m hoping it doesn’t get any worse. If you want to get a good synopsis of the whole situation, I HIGHLY recommend listening to the most recent episode of the All-In podcast,

In light of these events, I want to tie in today’s blog with all the madness that went down. Today’s blog will be about one of the benefits that blockchain & crypto technology provides that could have potentially avoided this fuss: digital self-custody.

Let’s dig in!

What is a bank run?

Before jumping right into the idea of digital self-custody, let’s first discuss the recent SVB collapse from the run on the bank. At a high level, a bank run is a situation where many customers withdraw their deposits from a bank at the same time, usually due to concerns about the bank's solvency and liquidity. However, it’s not the insolvency or illiquidity of the bank itself that causes the run on the bank, but rather the confidence the general public has in the bank due to those potential factors. To best understand what causes a bank run, it is useful to run it back to Econ 101 (for those who took it) and talk about the most famous game theory example: the prisoner’s dilemma.

The prisoner's dilemma is a classic game theory problem where two suspects are caught by the police, and each is given a choice: stay silent, or betray the other and confess. If one confesses and the other doesn't, the confessor goes free while the other serves a longer sentence, and if both remain silent, they both serve a shorter sentence than if they both confess. If all this text was too confusing, here’s a quick graphic to explain:

In aggregate, the optimal solution would be for both parties to remain silent as they would only serve a total of 2 years (in this example). However, in the prisoner’s dilemma, you cannot trust the other person & “rational” actors act in their own personal interest. Thus, the “rational” decision would be to confess every time.

With that context, let’s look at the SVB bank run. When rumors about SVB’s troubles started making the rounds, depositors in SVB had two options: withdraw funds or keep them in the bank.

From the depositors’ perspective, the downside of taking your money out ASAP is the inconvenience of having to deal with taking your money out of the bank while the upside is that you keep 100% of your funds. On the other hand, the downside of not taking your money out is potentially losing access to all your money while the upside is the convenience of not having to handle all those funds if the bank is fine (BIG “if”).

In this instance, the rational decision would be to pull your money from SBV ASAP. When the first few depositors did this, everything was fine as they simply took money from SBV’s cash reserves. However, when more and more people started withdrawing funds, SVB was forced to sell some of its longer-dated assets (10-year duration bonds) to make its customers whole. However, if you need to sell a lot of assets very fast, the value of those assets decreases significantly, which is perfectly displayed by this clip from the movie Margin Call.

Note: The meteoric rise in interest rates also played a role as people could earn a much higher yield (5%) than the 1-2% yield, 10-year duration bonds that SBV was selling.

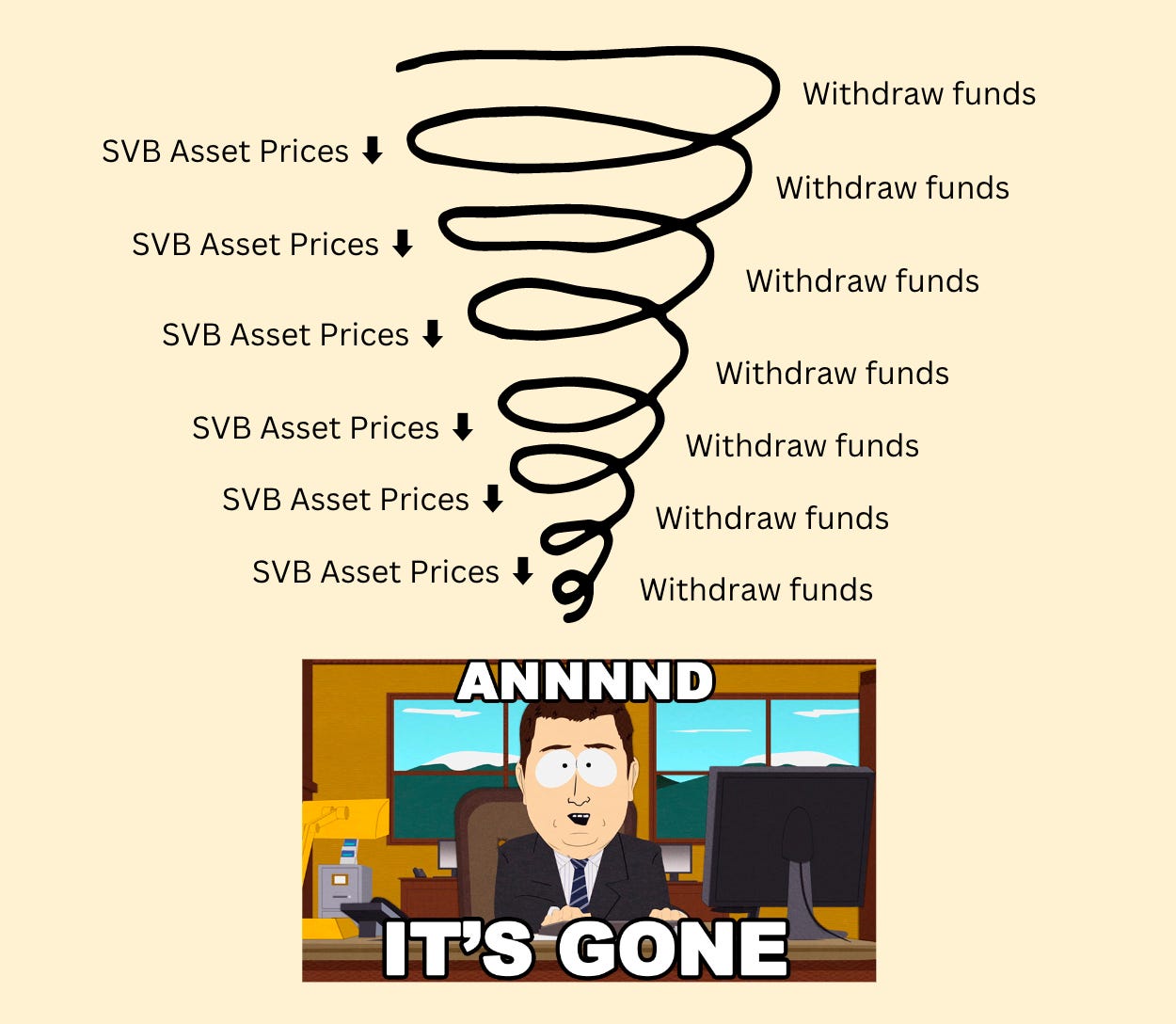

Thus, the run-on-the-bank problem causes a decline in the assets the bank owns, which then causes more people to take out their cash, which causes a further decline in the assets the bank owns…creating a downward spiral effect:

To use the prisoner’s dilemma, you have the depositors that remained silent get screwed over by the ones who decided to confess (in reality, it was just a competition of who could pull their money the quickest). Thankfully, it seems as if the government is stepping in and saving the day (which I am typically not a fan of tbh) or else we were about to see thousands of US startups go belly up for doing nothing other than deciding to custody their funds into a regulated, top 20 US bank.

Self-Custody vs. Custody

Now that we know what a bank run is, let’s talk about custody.

Custody is the idea that you entrust your valuable assets (cash, jewelry, etc.) to a third party to keep them safe and secure. A common example of a custodian (the third party who has custody of your money) would be a bank. Banks hold your cash for you so you don’t have to worry about it being lost or stolen (most of the time), and also make it super easy for people to use those funds digitally through the use of physical cards (debit & credit) and apps like Venmo.

Self-custody, on the other hand, is when the owner of the valuable assets (aka yourself), takes responsibility for protecting their assets. A common example of this would be storing any valuables in a home safe, putting money in a piggy bank next to your bed (if people still use piggy banks), or…literally using cash as your bed:

The most common method used to spend money that you self-custody is cold hard cash, which is extremely inconvenient in today’s digital world. I mean, just try to think back about the last time you used cash to pay for something (if you even have cash in your wallet at all).

Due to the ease of use, and the fact that some people might trust banks more than themselves with their own money, most people (at least in the US) choose banks to be the custodians of their assets. Don’t get me wrong, this belief comes with reason: banks are regulated by government agencies more than any other non-governmental institution and have been around for centuries. However, as we’ve seen over the last week, banks are not perfect and are highly susceptible to public perception. So what is the perfect solution? Maybe this chart can clarify it:

Solution: Digital Self Custody

If you want the best of both worlds (self-custody & easy to use), you need a way to take custody of your assets while still being able to use and transact with those assets in a digitally native way. This is what I call digital self-custody.

Thankfully, the technology to make this possible already exists via the blockchain. As I’ve stated in one of my previous blogs (My Favorite Web3 Analogies), blockchain technology allows anyone to become the sole owner of their assets digitally, allowing them to send, spend, save, etc. those assets anywhere across the world like a digital piggy bank (as stated in the link above that you probably didn’t click).

Disclaimer: simply owning crypto does not mean you have custody of your own money! Exchanges like Coinbase & Binance (although great for the ecosystem) are just like any bank. Simply looking in the rearview mirror at the FTX debacle should explain that point.

Although there are tons of amazing blockchain tech developments going on (ex: NEAR’s Blockchain Operating System, shameless plug here), it is not easy to use on-chain assets for everyday transactions (i.e. groceries, gas, etc). Just like ogres, blockchains have layers. Without going into too much technical detail, here is a quick graphic of what the blockchain tech stack looks like (more info here):

However, to truly make assets that you self custody feel and act like digital payment systems that people use every day (i.e. credit cards, Apple Pay, etc), the industry will have to make significant improvements in a layer that sits on top of all the others: the interaction layer. I believe the interaction layer is the gold mine for unlocking the full potential self-custody on the blockchain as it erases the main advantage that banks have over people controlling their funds.

You may ask: “Interaction layer sounds cool and all, but what does that actually mean in real-world terms?” At a high level, think of it as using your debit/credit card or your iPhone with a chip reader at Walmart (for example) that connects to the blockchain and transfers funds from your crypto wallet attached to your card or iPhone to Walmart’s wallet. It would be just as seamless and easy as payment systems are right now but without the need (or fear after this weekend’s events) of going through a bank.

Hopefully (fingers crossed), we are closer to that end goal than it appears. One significant Web3 news development that went under the radar amidst the FTX collapse was Circle, the creator of the USDC stablecoin (for newcomers, think US dollars on the blockchain) integrated with Apple Pay, making it easier for both traditional and crypto-native businesses to use crypto in their day-to-day operations. Furthermore, Kraken, one of the longest-running and trusted cryptocurrency exchanges, is launching its bank in the US later this year to offer “a more seamless integration between crypto and the traditional financial system.”

Conclusion

It appears as if we’ve steered clear of the “Perfect Storm” for the time being, but the entire American banking system was navigating some choppy waters over the past few days. Even though banks have been one of if not the most stable pillars of American society since the birth of our nation, blockchain technology has the potential of disrupting this stalwart industry. Blockchain technology can accomplish this tall goal by providing the same ease of use that banks do while putting custody in control of the only thing that people trust more than their bank: themselves.

Thanks for reading! With my current roommate working in investment banking during all the SVB drama, I’ve had tons of time by myself to think. Thus, I’ve got blogs planned for the next 3-4 weeks, so stay tuned and have a great rest of your week!

Click the links below if you dare: