Bye Bye Extractive Middle Men

A look at one of the many reasons why blockchain technology is so impactful

Welcome to the 1 new 12 Cities, 12 Months subscribers who have subscribed to this struggling blogger since last Wednesday! If you haven’t subscribed, join 12 other people who are following the journey!

Hey everyone! Hope y’all had a great week, especially with all the madness going on. And no…I’m not talking about the madness revolving around the regional banking system in the United States. I’m talking about something much more fun than that: MARCH MADNESS!

There is arguably no other tournament in the world that is as action-packed or insanely entertaining as the NCAA’s March Madness. Furthermore, the tournament has a unique ability to get people excited and invested, even if they have no personal connection to the teams or haven't watched any college basketball games all year.

Unless you’ve been living under a rock (or are reading this from another country where the tournament isn’t completely consuming all sports media at the moment), the beginning of this year’s tournament has been one of the best ever! Everything from crazy endings, shocking upsets, and…as always…zero perfect brackets.

Craziest ending:

Craziest upset (& arguably the greatest in history):

Although I’d love to spend more time writing about and sharing videos about March Madness, I want to get into today’s topic and explain why/how blockchain technology will revolutionize our daily lives by removing extractive middlemen. Let’s dig in!

The Evolution of the Web

To set the stage, let’s quickly revisit a point I’ve mentioned in previous blogs. The evolution of the internet has gone through several stages, from its inception to the current era of decentralized technologies. Here's a brief overview of the transition from Web1 to Web2 and finally to Web3:

Web1 (The Read Internet)

Web1, also known as the "static" web, marked the beginning of the internet as we know it. It mainly featured:

Static web pages - Web pages were built using basic HTML and lacked interactivity. Users could merely read information without modifying page content.

Limited multimedia support: Images and simple animations were supported, but videos and complex animations were relatively scarce.

One-directional information flow: Content creators published information, and users consumed it without the ability to engage in real-time interactions.

At a high level, Web1 basically just put libraries (aka information) online. Thus, all users were able to do was read online and not much else.

Web2 (The Read-Write Internet)

Web2, or the "interactive" web, brought about significant changes in the way users interacted with the internet. Key features included:

Dynamic web pages: The introduction of programming languages like JavaScript allowed for greater interactivity and personalization on websites.

Social media platforms: Web2 ushered in the age of social media, enabling users to communicate, share content, and collaborate in real time.

User-generated content: Websites like blogs, forums, and wikis allowed users to create and share content, democratizing content creation on the internet.

At a high level, Web2 allowed people to now only consume content online, but also create content through platforms than enabled blogs, photo-sharing, and cringe-worthy dance & street interview clips (aka TikTok). During this phase of the internet, there we many “middleman” tech businesses that were created and prospered as they were able to sell the digital gold of the internet: user data.

Web3 (The Read-Write-Own Internet)

Web3, the "decentralized" web, is the next stage in the evolution of the internet, leveraging blockchain technology to facilitate secure, transparent, and equitable transactions. It is characterized by:

Decentralized applications (dApps): These applications run on decentralized networks, such as Ethereum, instead of centralized servers, fostering trust and minimizing reliance on third-party intermediaries.

Smart contracts: These self-executing digital contracts automatically enforce agreed-upon terms, removing intermediaries and enabling secure, direct transactions.

Tokenization and digital assets: Assets like art, real estate, and intellectual property can be tokenized on the blockchain, allowing for decentralized ownership and trading.

The takeaway you need here is that with Web3, value & data can be transacted digitally in a peer-to-peer, transparent way. If you are a Web3 native, that last sentence probably made sense to you. If you are not, let me break it down bit by bit.

Value and data: Can be in the form of money (cryptocurrency) or information about what transactions are occurring, aka data (aka, how big tech makes money from its users by offering a “free” product)

Transacted digitally: sending things over the internet via phone, computers, etc.

Peer-to-peer: between two people and two people only. You sending money to someone over Venmo isn’t peer-to-peer as we use Venmo to facilitate that transaction. You handing cash to a friend is peer-to-peer

Transparent: Anyone can see what is occurring on the blockchain, unlike the siloed walls of big tech companies that take user data and sell it to advertisers

This blockchain superpower has the potential to disrupt a lot of business models that exist today, and it’s only a matter of time before we start seeing new blockchain-enabled companies challenge and overthrow industry giants.

What is a Middleman Business?

Alright, enough Web3 talk, let’s get to a topic everyone has some familiarity with, middleman businesses. Generally speaking, a middleman business acts as an intermediary between producers and consumers, facilitating transactions and providing valuable services. They offer essential support (debatable at times) to various industries by connecting buyers and sellers, ensuring the efficient distribution of products and services. Common examples of middlemen businesses include wholesalers, retailers, distributors, brokers, and agents. They typically generate revenue through one or more of the following methods:

Commissions: Middleman businesses charge a percentage of the transaction value as a fee for their services. For example, in the real estate industry, agents receive a commission based on the property's sale price.

Fees: Some intermediaries charge a fixed fee or a subscription-based pricing model for their services. For instance, online marketplaces like eBay and Etsy charge sellers listing fees and transaction fees.

Spread: Financial intermediaries, such as stockbrokers or foreign exchange dealers, make money by charging a spread between the buying and selling prices of financial instruments. This difference represents their profit margin.

Markup: Wholesalers and retailers typically purchase products from manufacturers at a lower price and sell them to consumers at a higher price, pocketing the difference as markup.

Advertising and Sponsorships: Some middleman businesses, such as online platforms or media companies, generate revenue through advertising and sponsorships by promoting products or services on their platforms.

All these different ways of monetizing a business sound great and all until you realize the dark truth of most of them (besides advertising & sponsorships). All of these revenue-generating models for middleman businesses come at the cost of the people they are supposedly there to help: customers. We’re so ingrained in this type of system that it’s hard to think of all the businesses that extract value from the producer and end user of a product or service. Have no fear though…Will is here, and I’ll lay out a few examples of extractive middleman businesses and how blockchain can disrupt them.

Examples of Extractive Middle Men

Banks

I wrote all about banks in last week’s blog (shameless plug), but they provide a perfect example here as well. Generally speaking, what banks do is take custody of your money and allow you to use that money digitally via credit cards, Venmo, etc. In return, banks take the money you gave to them, invest it, and keep the majority of those returns to themselves (besides the measly .1% return on your savings account).

Blockchain technology disrupts banks as a middleman for storing the value as enables people to store their funds while still allowing them to transact those funds digitally. Thus, instead of banks being able to make money from safely storing your cash (hopefully) and making your cash easier to use, people can do that on their own, and thus, obtain the money banks used to earn for themselves.

Record Labels

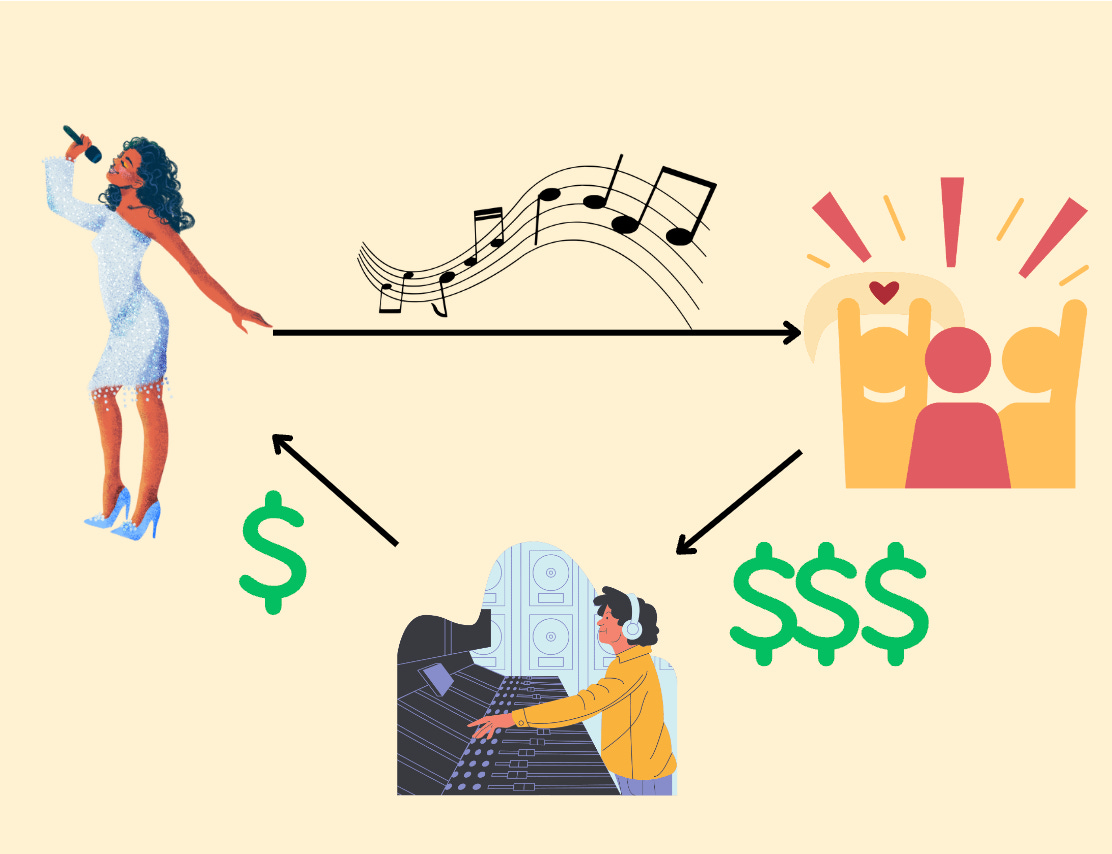

Recording studios are one of the most notorious middleman businesses due to the sheer amount of value they extract from music artists. Some estimates say they take, on average, 50-90% of what an artist or band makes. However, artists don’t make music for the record labels, they make music for their fans, so why should there be an entity in the middle of that exchange abstracting that much value?

Using Web3, artists can go directly to their biggest fans and supporters to obtain the money needed to record more music, produce music videos, market themselves, and more. An artist can even do this even today through platforms like Royal, Audius, and Sound.xyz. By utilizing the blockchain, artists can keep more of the profits that they create for themselves to produce more music, create better content, and more. Furthermore, similar to the traditional model, artists can share royalties and earnings with those that funded their work, but instead of record labels, it would be their most loyal and passionate fans.

Ticket Reselling Services

There has been tons of controversy around these types of companies recently (really more like company). If you are one of the millions of Swifties out there, you would know that there was a huge controversy recently over the sale of her Eras Tour tickets as fans were not able to access the site due to it crashing, not loading, etc. There were even some fans who had a pre-sale code who weren’t able to get their tickets.

Aside from that, ticket reselling services (besides just ticket master) are known for charging a ridiculous amount of add-on fees to their tickets. Even since I started my 12 Cities, 12 Months journey, I’ve had two instances where I was shocked at how much I had paid compared to what the original price showed. I paid 28% more at checkout than the initial price at the Savannah Bananas game and 25% more at a concert I went to on Sunday night. The sheer amount of extraction that these companies take from the exchange between artists, athletes, performers, etc., and their fans makes me feel like Jesse Pinkman from Breaking Bad.

However, blockchain will change the game in this industry. Blockchain can allow performers to go direct to consumers with tickets to their shows, concerts, games, etc. with something as simple as an NFT (each one correlating to a different seat at the venue). There are companies, such as seatlab (built on NEAR), that are making NFT ticketing significantly easier for companies, artists, and more to utilize the blockchain to their advantage.

By using NFTs, the prices of tickets could be cut, making it cheaper for the end user and also providing the performer with a bigger piece of the pie. Furthermore, through NFTs, you can attach a royalty fee for any resale of the tickets to the artist themselves instead of royalties going to Ticketmaster. This is a win-win for the two parties that actually matter in this equation (performers and their fans) and it’s only a matter of time before more performers and venues start turning to these new solutions.

Wills

As I’ve talked about in a previous blog (shameless plug as always), I actually worked on a company my senior year at Tulane that was aimed at disrupting the will & inheritance industry. At a high level, all a will or trust is meant to do is transfer assets from one individual to the other. Sounds simple enough, right? However, to make that seemingly simple transaction happen, you need lawyers, notaries, and probate courts to facilitate everything (disclaimer: for complex estates, a lawyer is still recommended. For simpler estates, digital solutions work well).

Instead, what if, upon receiving a death certificate, the will uses a smart contract to distribute the assets of the will to all those involved?

The process would look like this:

Create a smart contract with the terms of the will

Include the names and addresses of the beneficiaries

Add conditions that trigger the execution of the smart contract (ex: the presentation of a death certificate)

Upon trigger, the smart contract automatically distributes the assets to the beneficiaries of the will

In this process, the time it would take to transfer assets from the deceased party to their beneficiaries would increase dramatically as

“Just like any contract, smart contracts lay out the terms of an agreement or deal. What makes smart contracts “smart,” however, is that the terms are established and executed as code running on a blockchain, rather than on paper sitting on a lawyer’s desk.

It may take longer for this example to come to fruition compared to other ones on this list given how long it takes to pass legislation in the US (even if it makes complete sense), but I am hopeful that one day we will see blockchain wills be the norm.

Remittance Companies

For any readers here who are US natives, you may not be too familiar with the remittance industry in the US. It is dominated by a few major players like Western Union & MoneyGram. Due to this market dominance, these remittance service companies can take a 5% cut from every transaction. When individuals are sending this money to places where their family needs it, every dollar counts.

The blockchain disrupts and improves this system immensely by enabling these crucial value transfers to happen within seconds, cost less than a single dollar to occur (and sometimes less than a cent), and become available for those who are even unbanked. All you need to make this transaction happen is an internet connection and a crypto wallet: simple as that.

This ease of use and access to US dollars from family members living in the US is increasingly useful to those who live in countries where hyperinflation exists. Argentinan citizens, for instance, have started swapping their native currency (Argentinian pesos) for US dollar-denominated stable coins as a means to protect against hyperinflation. We’ll see if this was a smart move by the Argentine folks or if they simply swapped one hyper-inflating currency for another after Balaji Srinivasan made a prediction that BTC would hit $1 million in 90 days due to USD hyperinflating.

If you want to listen to Balaji’s reasoning, I recommend listening to this pod:

Conclusion

Blockchain technology has the potential to revolutionize the way we conduct transactions and interact with each other online. By removing extractive middlemen and creating decentralized networks that facilitate secure and transparent transactions, blockchain-enabled companies can challenge and disrupt traditional business models that we have taken for granted over the years. As we move towards a Web3 world, we can expect to see more innovation and creativity in the way we exchange value and data online, paving the way for a more equitable and decentralized future. After reading this blog I encourage you to try and look at other companies that you may interact with frequently and think to yourself, “is this a middleman that blockchain can replace?”

Thanks for reading! I’m looking forward to watching some Sweet Sixteen action and enjoying Charlotte finally starting to get warm. Be on the lookout for next week’s blog, and stay inspired amigos.

Click the links below if you dare: